Many restaurant chain operators have a manual process for sourcing new products, identifying new vendors or for evaluating market pricing levels. Manual processes not only drive extended sourcing timelines, but also prevent buyers from being proactive in their strategy.

6 Best Practices for Improving Your Sourcing Strategy

Topics: Strategic Sourcing

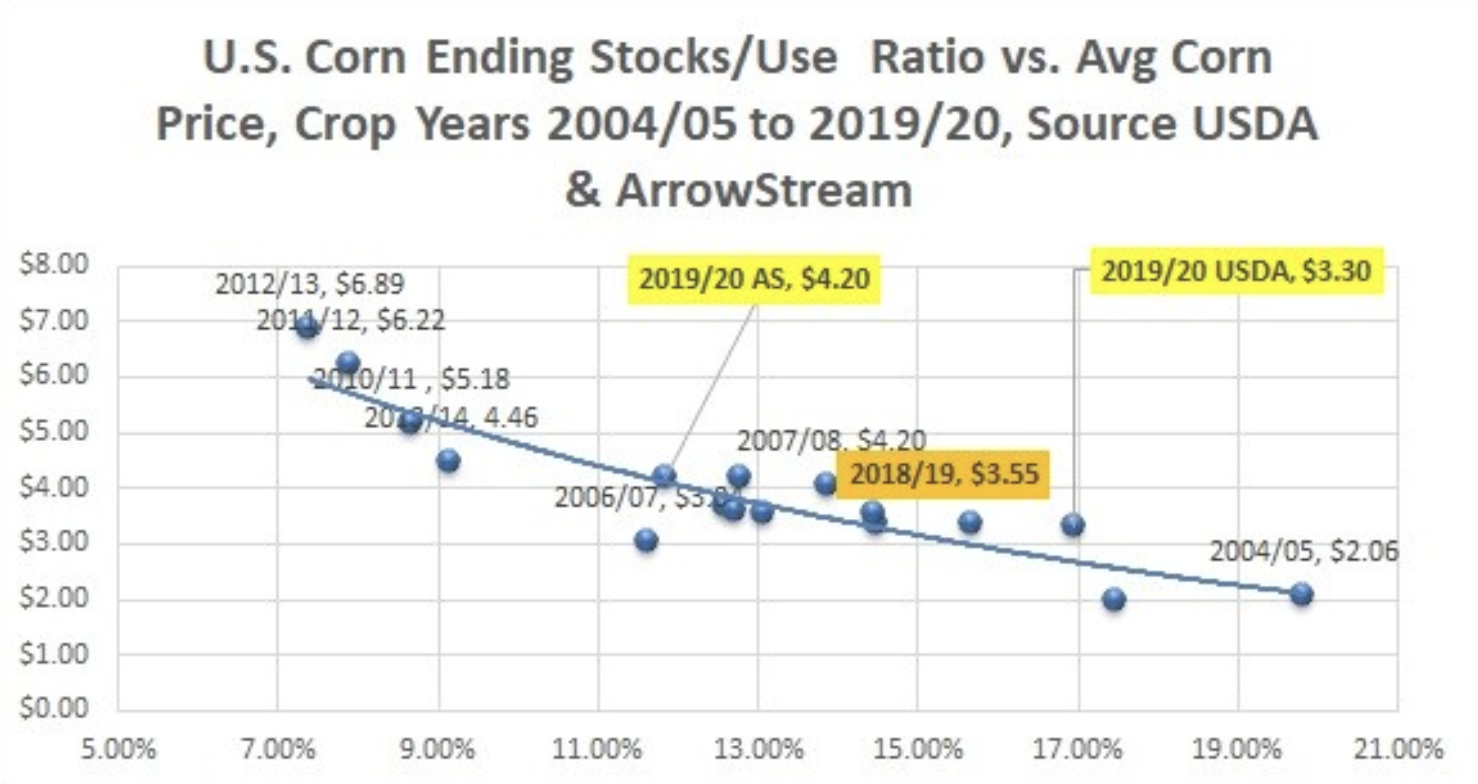

ArrowStream's commodities expert, David Maloni, continues to monitor the U.S. corn supply and its impact on protein for the foodservice industry.

Topics: Market Intelligence

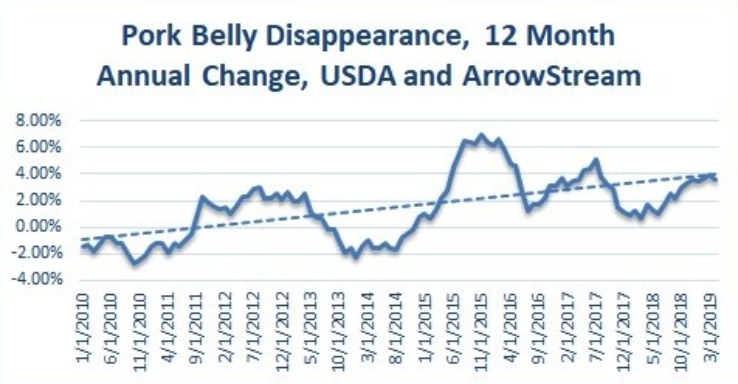

ArrowStream commodities expert, David Maloni, continues to have concerns about domestic pork supplies in the coming months due to China’s protein supply gap. Discussed in today's Weekly Commodity Report, Maloni believes this may also include pork bellies.

"There is no indication that this is curbing domestic bacon demand," said Maloni. "In April, U.S. pork-belly disappearance (think: consumption) was 6.9 percent bigger than the previous year, marking the seventh consecutive month of annual gains. And as the chart shows, the 12-month sum of pork-belly disappearance stands near 4 percent above 2018 near trend line growth. The risk in belly prices in the next several months is to the upside."

Topics: Market Intelligence

Protein Price Risks Remain Despite No Deal with China

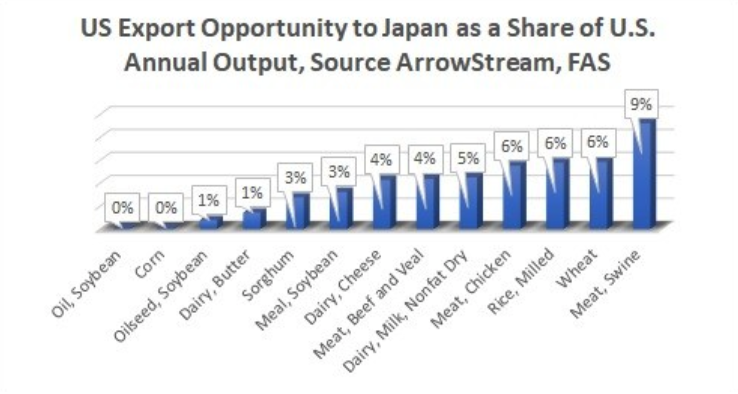

The May 21st issue of ArrowStream's Weekly Commodity Report discusses the outlook of trade deals with Asia. Commodities expert and EVP of Analytics at ArrowStream, David Maloni, summarized his perspective:

Topics: Market Intelligence

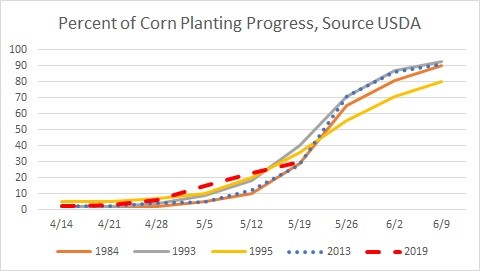

ArrowStream's commodity expert, David Maloni, published in today's Weekly Commodity Report that somewhere between 200 million and 500 million bushels of corn are at risk due to planting delays.

Topics: Market Intelligence

As a foodservice supply chain technology company, ArrowStream's blog will focus on bringing our audience of operators, suppliers and distributors, the following topics for best practices and updates on:

- Supply chain management efficiencies

- Strategic sourcing

- Food safety and quality

- Supply chain partner collaboration

- Market intelligence

We are dedicated to powering safe and intelligent foodservice supply chain management by merging data, operations and business relationships. Learn more at www.arrowstream.com.

Topics: News