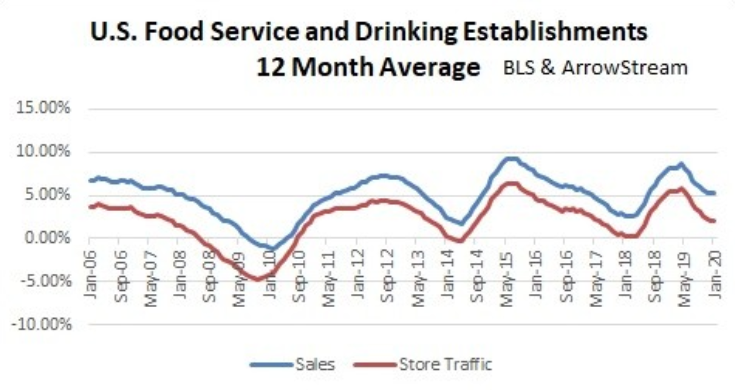

In normal times, ArrowStream's economists would have focused on reporting February restaurant sales, which were 5.2 percent better than the prior year (due to a 2.2 percent gain in traffic and 3 percent increase in menu prices). However, that pales in comparison to the current landscape of the restaurant industry battling the coronavirus (COVID-19) outbreak.

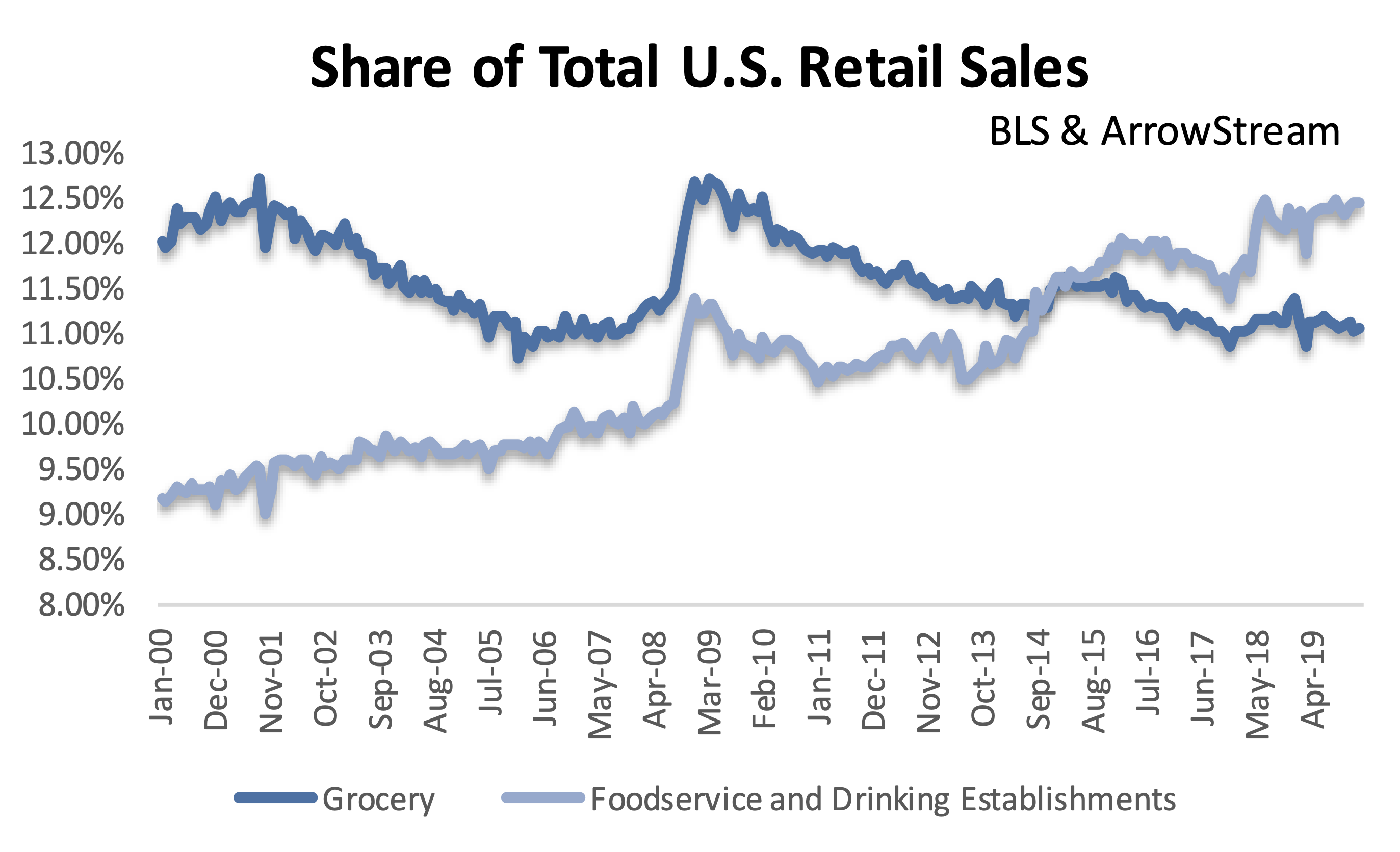

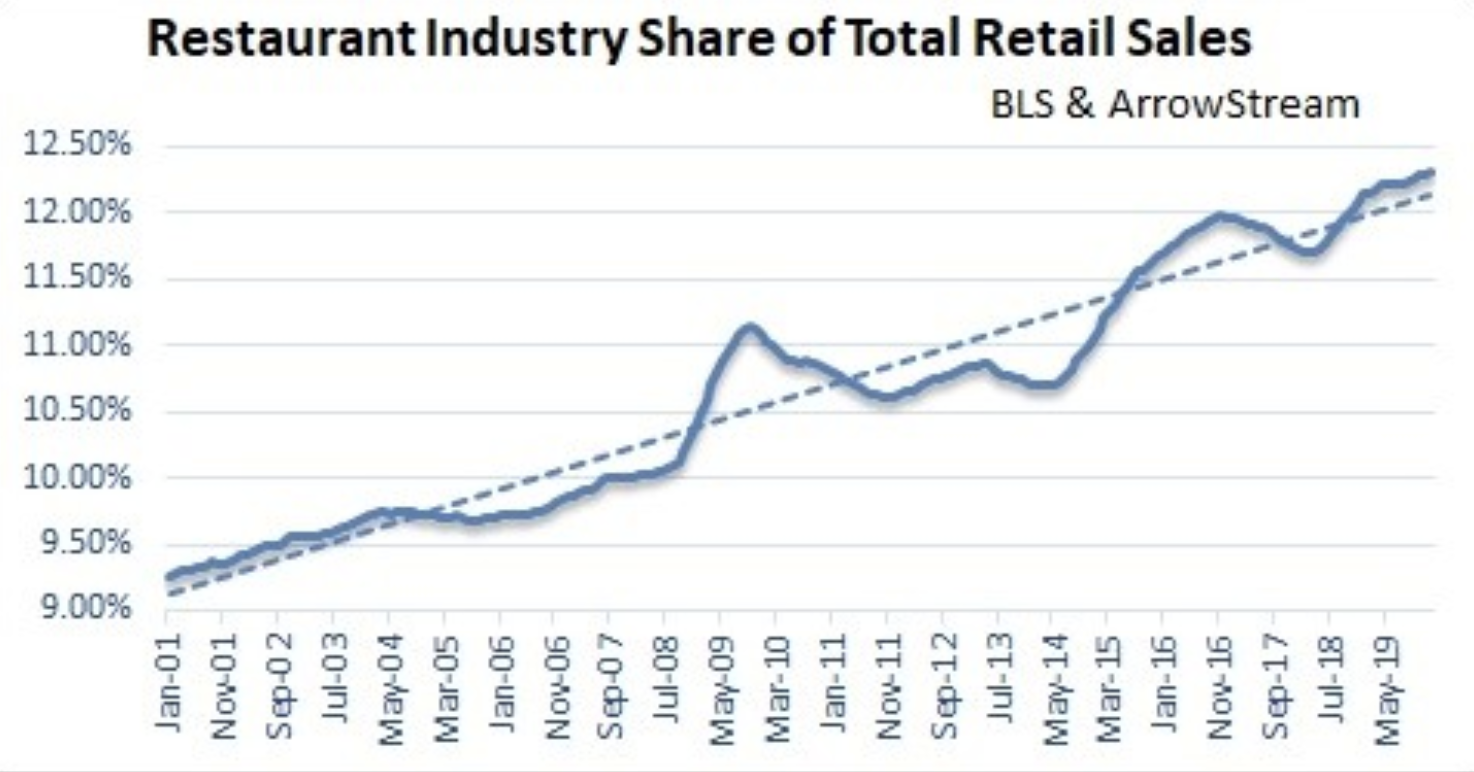

Restaurants the Third Largest Share of Retail Sales on Record: Shows Greater COVID-19 Impact

Topics: Market Intelligence

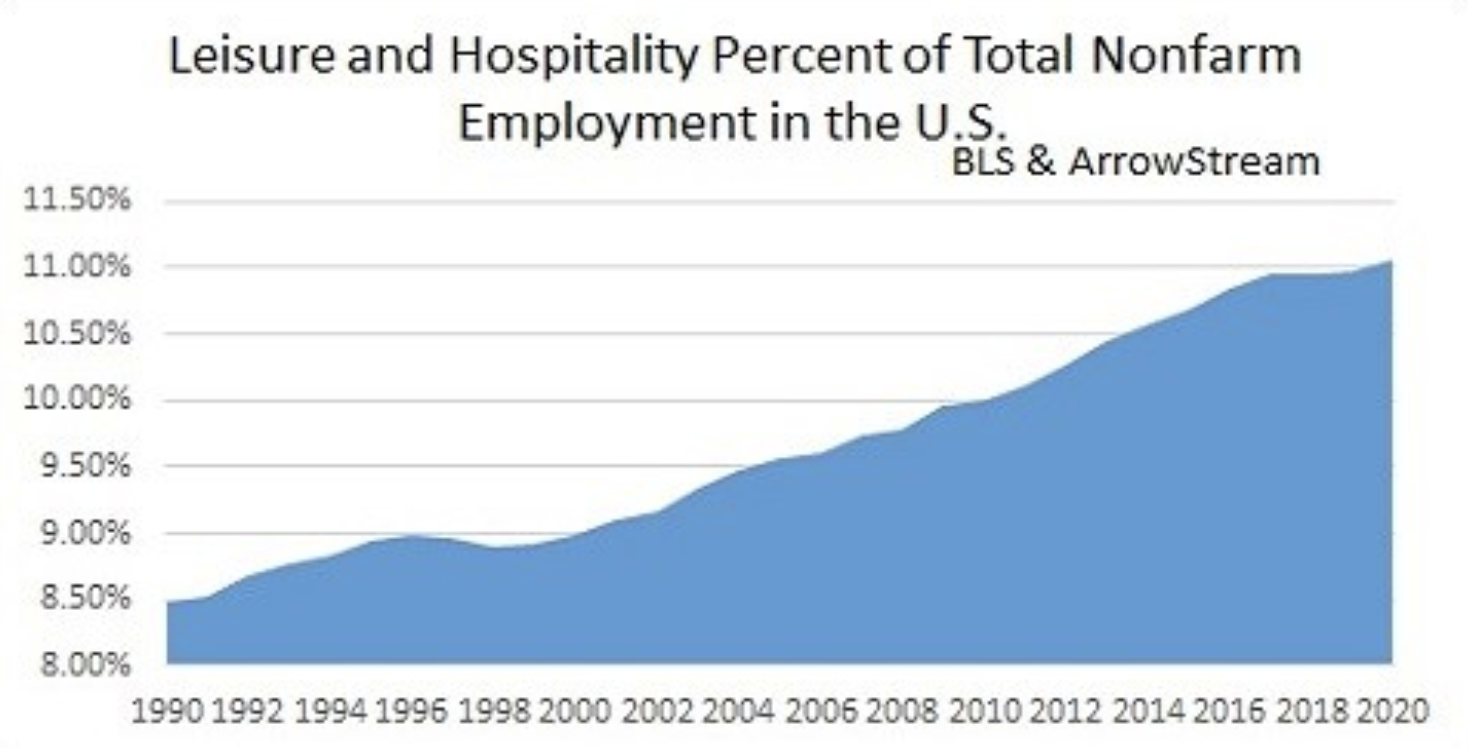

Leisure & Hospitality is the Fifth Largest Employer: Restaurant Bailout Makes Sense

News broke Wednesday afternoon that the Trump Administration is readying aid for closing restaurants in various forms. ArrowStream economists ran analysis on the “Leisure and Hospitality” category, which includes restaurants, and advise that a government bailout would make sense.

Topics: Market Intelligence

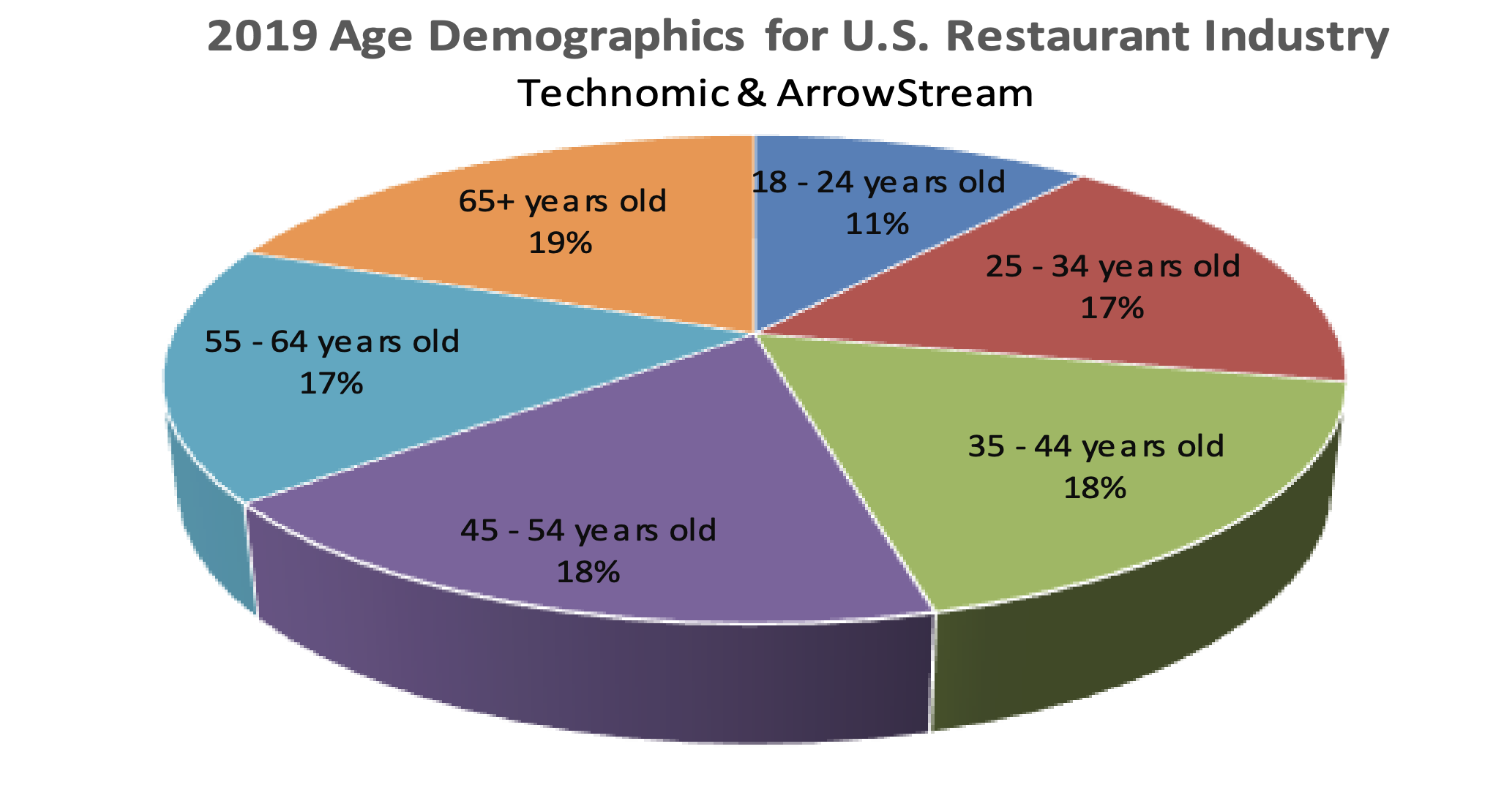

COVID-19 Impact: 17% of Restaurant Sales Dependent on Most At-Risk Adults

Several U.S. states and cities have announced blanket closures of bars and restaurants for dine-in service to avoid crowded spaces where COVID-19 will have the opportunity to rapidly spread. As this may significantly slow restaurant sales, not all sales will come to a complete halt, as most have been allowed to continue their drive-thru, takeout and delivery operations.

Topics: Market Intelligence

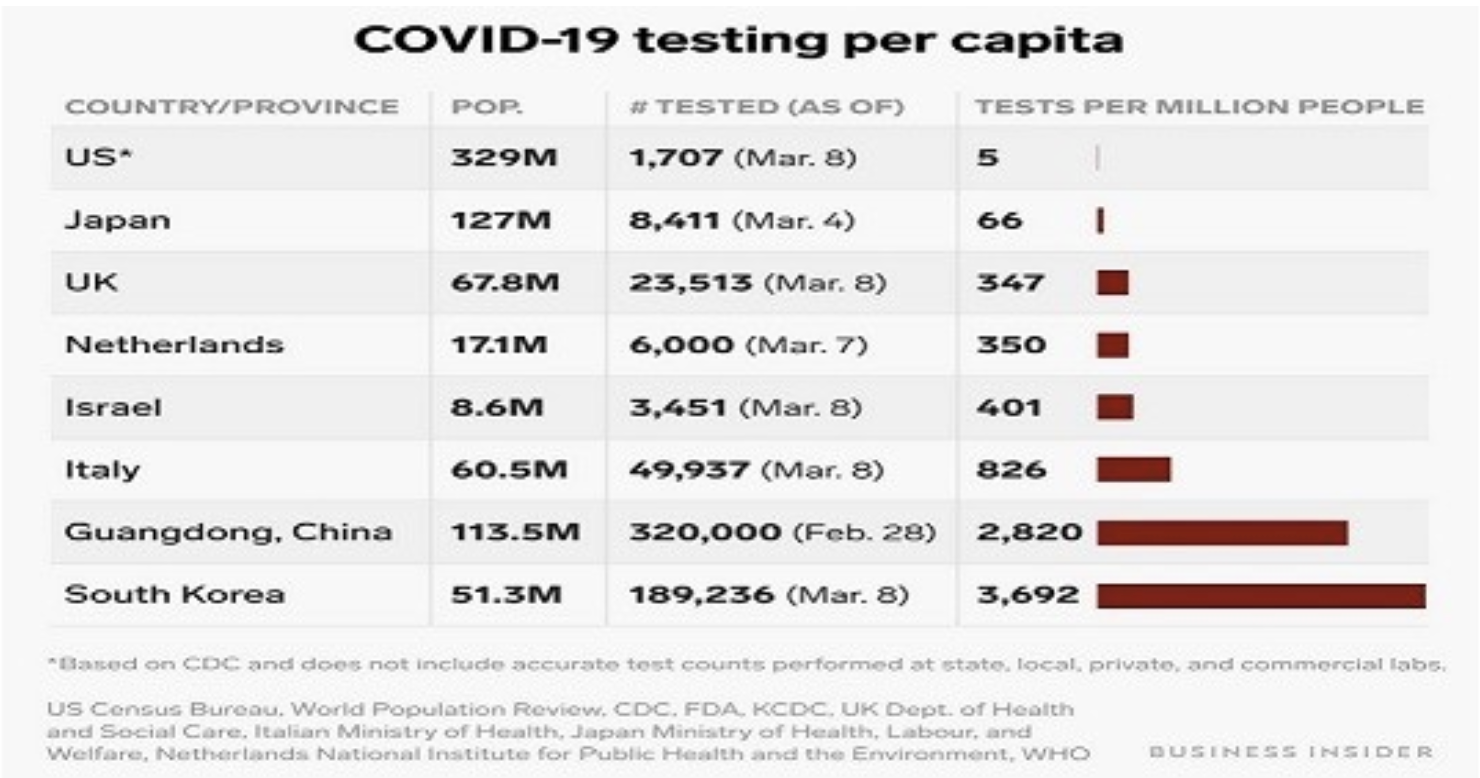

COVID-19 Continues to Cause Market Volatility for Foodservice Commodities

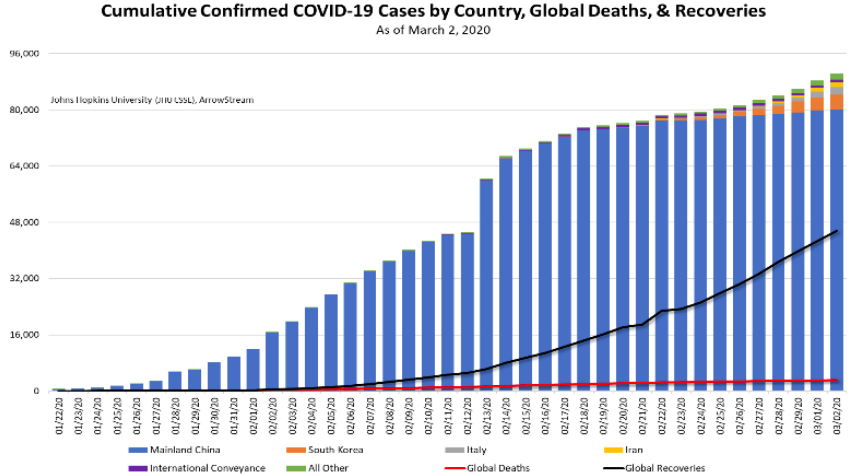

Despite last week's U.S. jobs data far exceeding expectations (added 273,000 jobs in February), the markets continued to digest the rising coronavirus (COVID-19) cases worldwide. ArrowStream economists continue to monitor and weigh in on the impact to the restaurant industry.

Topics: Market Intelligence

Coronavirus Starts to Impact Restaurant Consumers

The coronavirus (COVID-19) remains atop the market’s mind, but the trickledown effects impacting the U.S. restaurant industry are among the most significant unknowns. The U.S. central bank made an emergency cut on Tuesday, the first emergency move (and the largest rate cut) since the 2008 financial crisis in an effort to “boost household and business confidence,” but the rate cut isn’t likely to improve wider spread consumer fears, at least not in the near-term.

Topics: Market Intelligence

When the stock market crashed in February 2020 due to the worldwide panic of coronavirus, it brought flashbacks of the impact that the 2008 Great Recession had on the restaurant industry. ArrowStream economists asked Maloni Report subscribers this week whether the restaurant industry is ready for a recession -- are we?

Topics: Market Intelligence

ArrowStream economists reported impressive January restaurant retail sales, which were up 7.4 percent from last year.

"This was due to a 4.3 percent increase in traffic and a 3.1 percent rise in menu prices. The restaurant sales annual gain was the second largest in a year. Perhaps more impressively, restaurants carried the biggest percentage of total retail sales on record. And as the chart shows, this is a building trend."

Future Expectations

"Good news for the industry as a whole; however, competition in the industry will remain fierce."

Topics: Market Intelligence

With the newly released jobs data for December, which included average hourly earnings data for foodservice and drinking establishments, ArrowStream's economists compiled the full-year of 2019 labor costs for the restaurant industry.

Referencing the chart, they note, "at 31.7 percent [2019 costs were] essentially flat with the prior year and down from 2017, but still historically high."

Future Labor Cost Expectations

"Moving forward, it will be interesting to see if electronic orders and delivery help the labor percentage to decline as the industry becomes more efficient. We suspect it will."

Topics: Market Intelligence

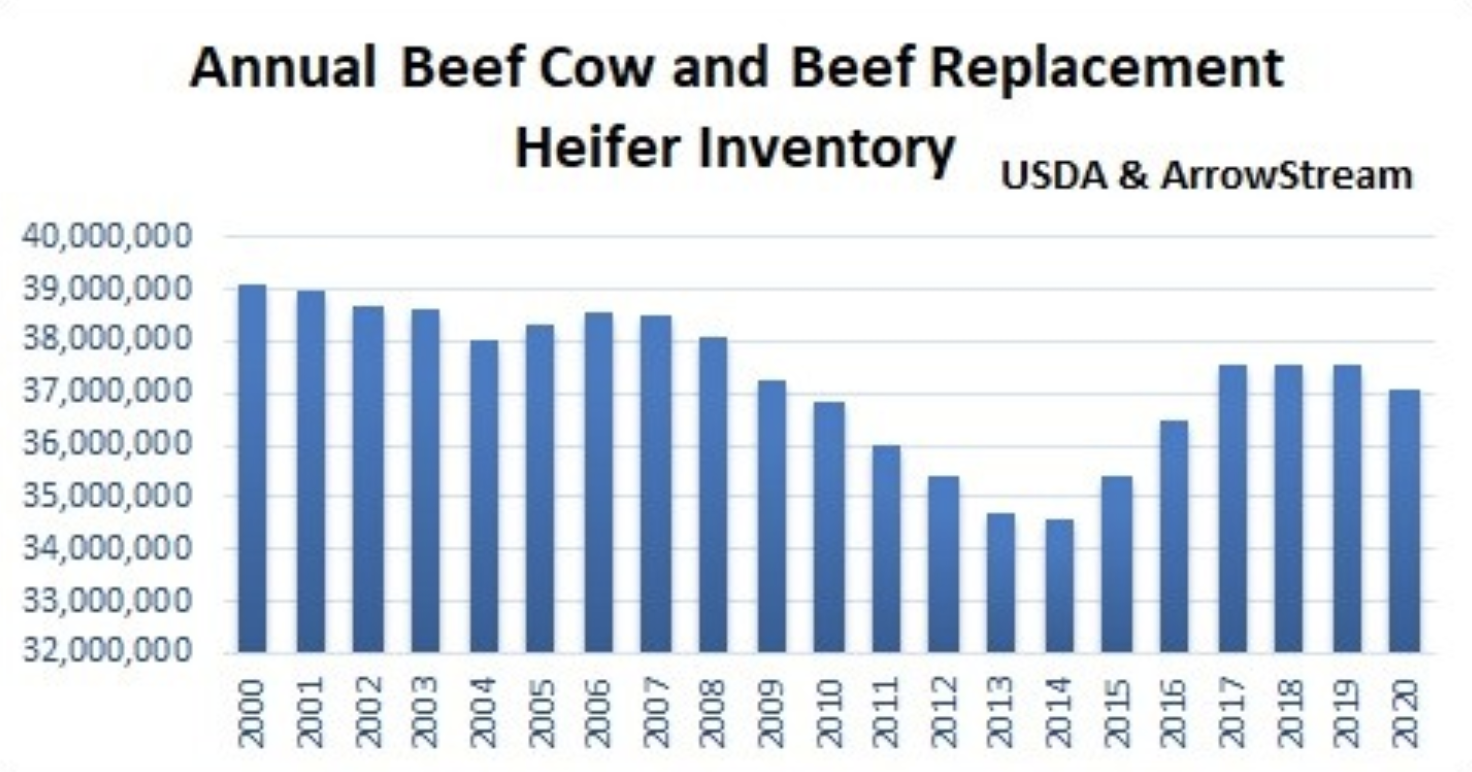

Economists at ArrowStream reported this week in the Maloni Report on the first annual decline in beef supplies since 2014.

Topics: Market Intelligence

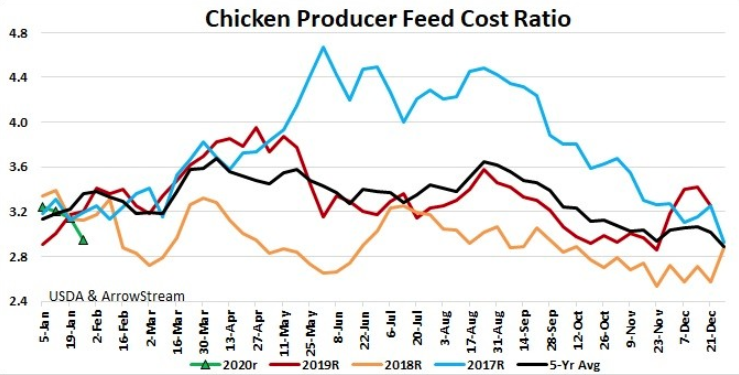

ArrowStream's economists noted in the Maloni Report this week that chicken production has been strong, with the six-week total tracking over 8 percent above year-ago levels. However, while they believe that's expected to continue into the spring, they also warn there is reason for caution.

Topics: Market Intelligence