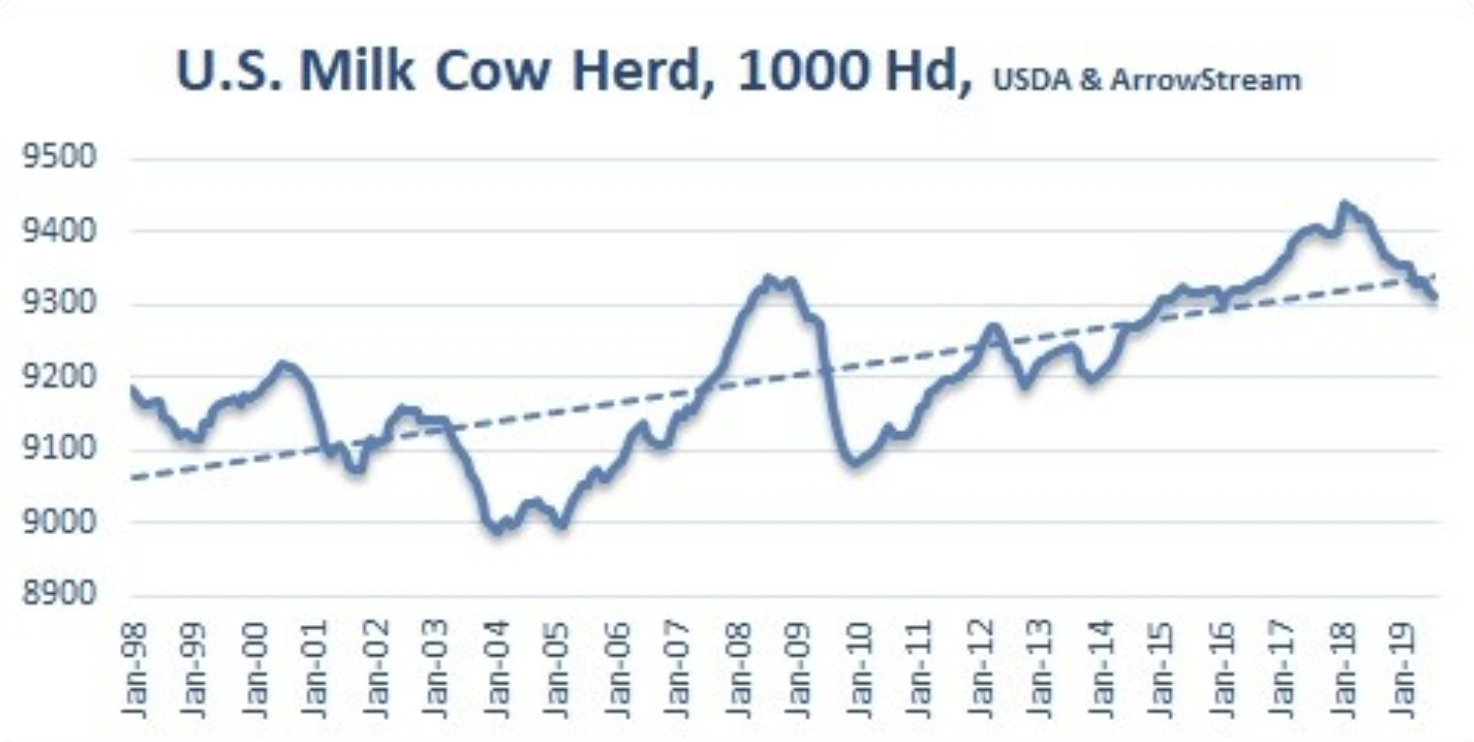

David Maloni, ArrowStream commodity expert, noted this week that July domestic milk production was nothing to get excited about as it was flat with the prior year.

Topics: Market Intelligence, Strategic Sourcing

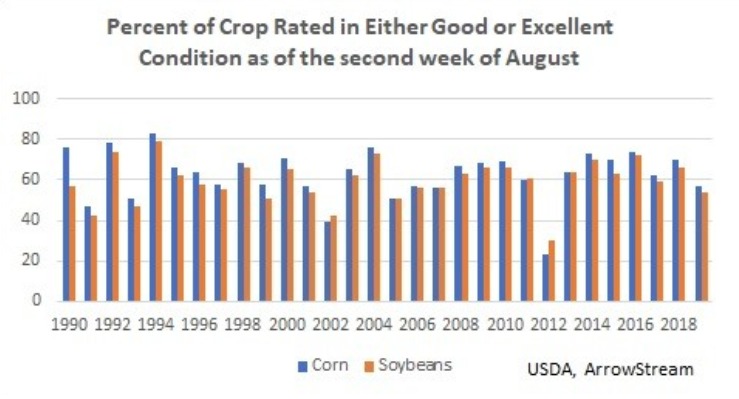

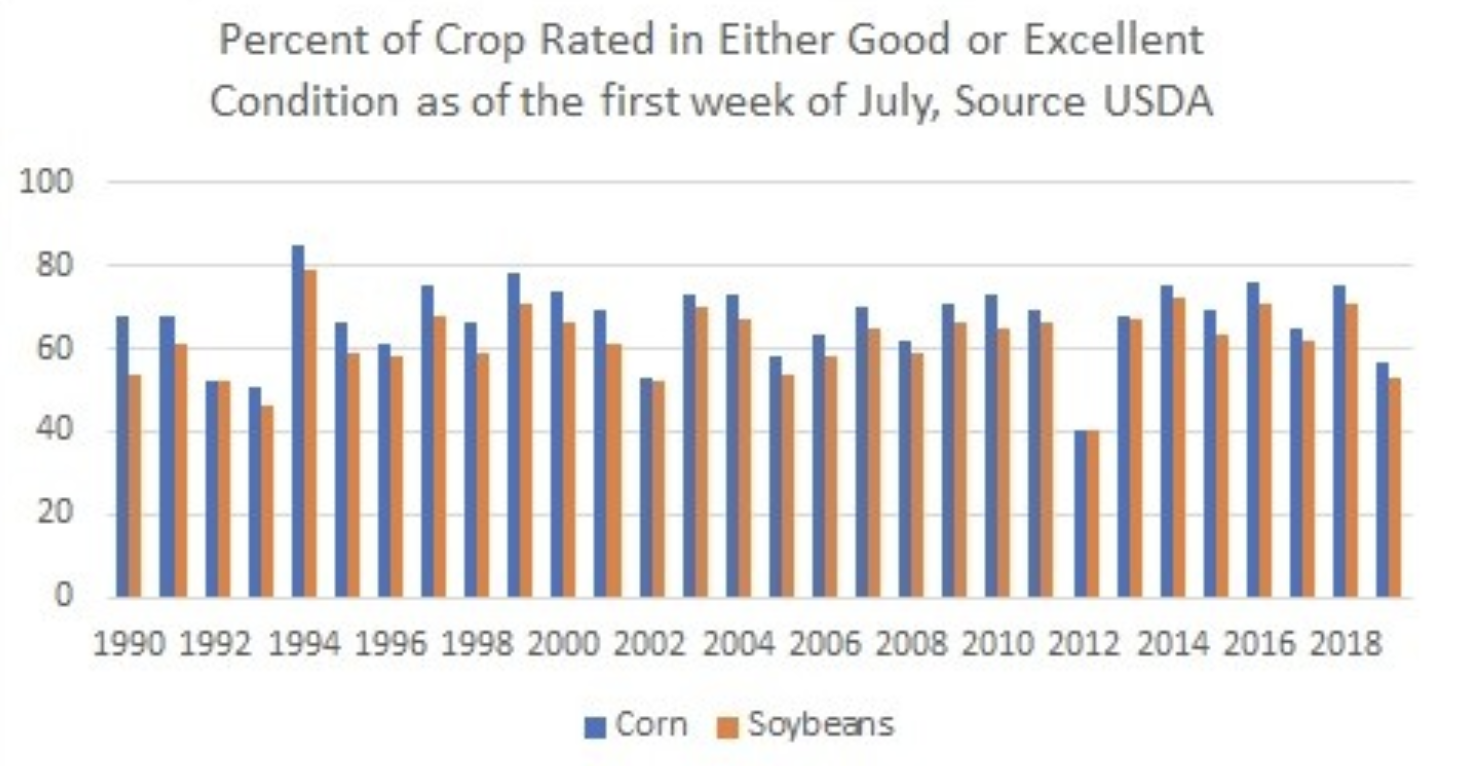

There have been questions in the trade about the USDA corn acreage and yield estimate numbers from last Monday’s reports. But, David Maloni, ArrowStream commodities expert, explains that, "reported prevent plant acreage through the Farm Service Agency (FSA) supports the acreage number. And, the corn condition ratings support the USDA yields number at 169.5. Although crop conditions aren't ideal, this is not 2012, which the chart shows. We at ArrowStream think there is a risk that the USDA reduces its corn yield and harvested acreage numbers in the coming months. But we highly doubt this will translate to sharply higher feed prices for 2020."

Topics: Market Intelligence

Has African Swine Fever Caused a Protein Supply Shortage?

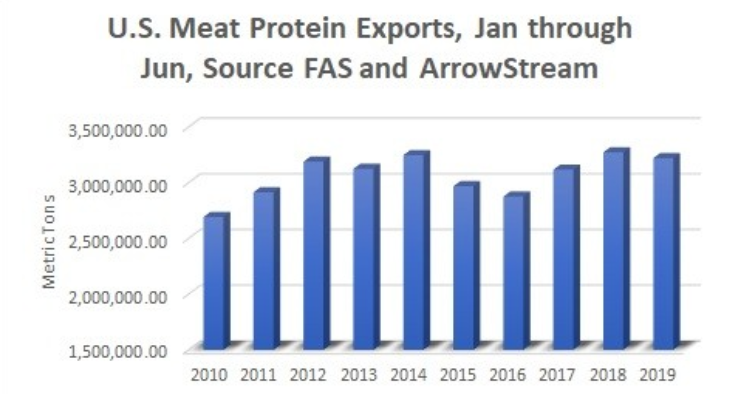

ArrowStream's commodity expert, David Maloni, noted from Friday’s monthly export data that pork carcasses were shipped to China in June for the first time on record and may signal an increase in U.S. pork exports to China in the coming months, despite the ongoing trade negotiations.

Maloni stated this week that, "there is no sign of a major world protein shortage in the U.S. trade data. U.S. total pork, chicken, turkey, and beef exports in June were 1.4 percent less than the previous year and in line with historical averages. In other words, no surge, but this is important to watch as 2020 approaches."

Topics: Market Intelligence, Strategic Sourcing

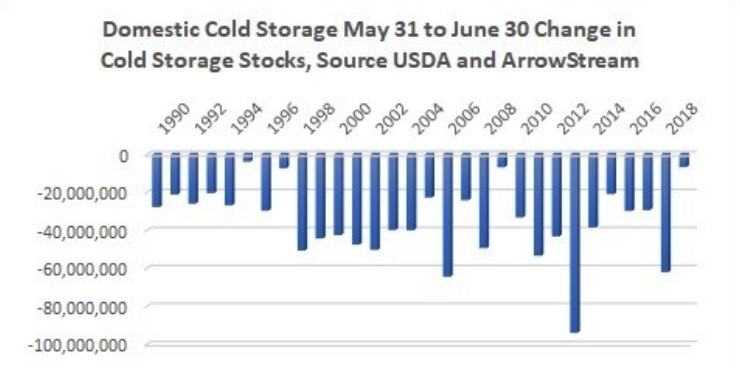

June's U.S. pork production was a whopping 5.9 percent larger than the previous year. ArrowStream commodity expert, David Maloni, feels that this and tempered domestic demand brought on by concerns of African swine fever, caused the U.S. June pork supply decline to be the smallest in 24 years.

"Bacon lovers will be happy to know that June 30 pork belly stocks were 6 percent higher vs. 2018 and experienced the smallest June drawdown in five years," said Maloni. "Despite concerns about supplies, pork belly disappearance was 5.7 percent larger than the previous year. Further, the 12-month belly disappearance average is at 4 percent above prior year reaching the highest level since summer 2017. It would not surprise us if, when it’s all said and done, pork belly disappearance is strong for July as well."

Topics: Market Intelligence, Strategic Sourcing

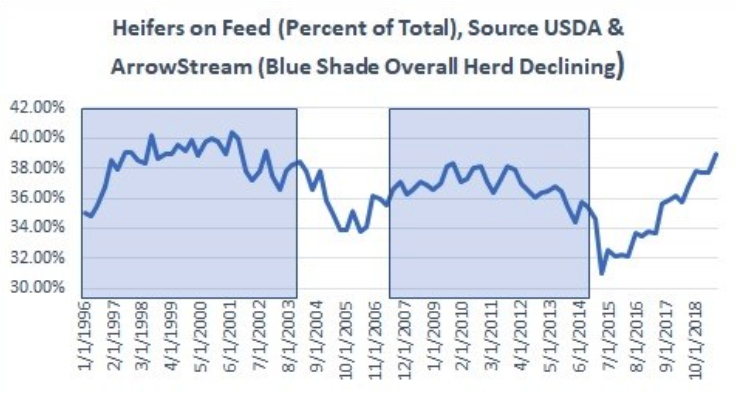

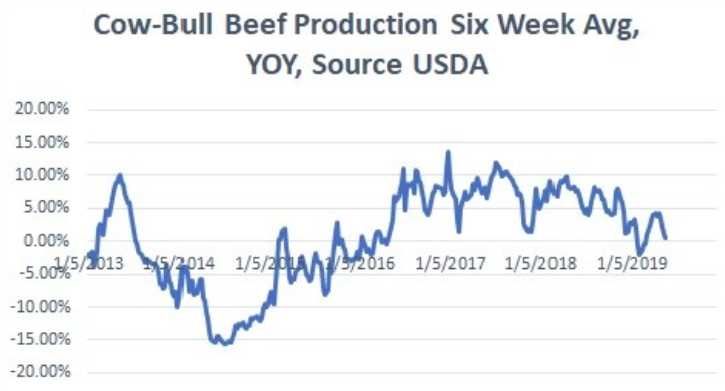

ArrowStream commodities expert, David Maloni, noted this week that data suggests the cattle herd has topped.

Topics: Market Intelligence, Strategic Sourcing

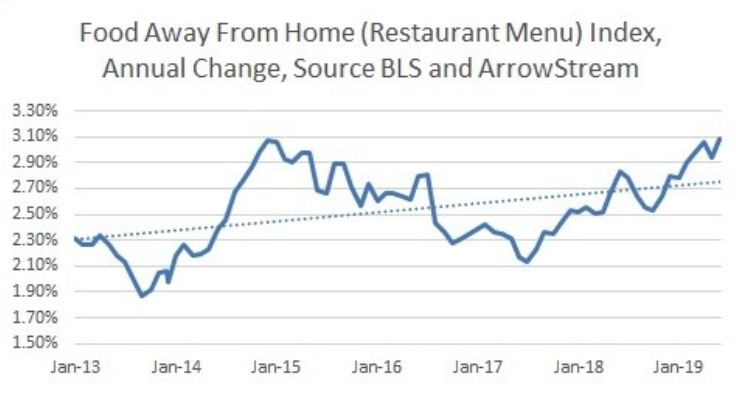

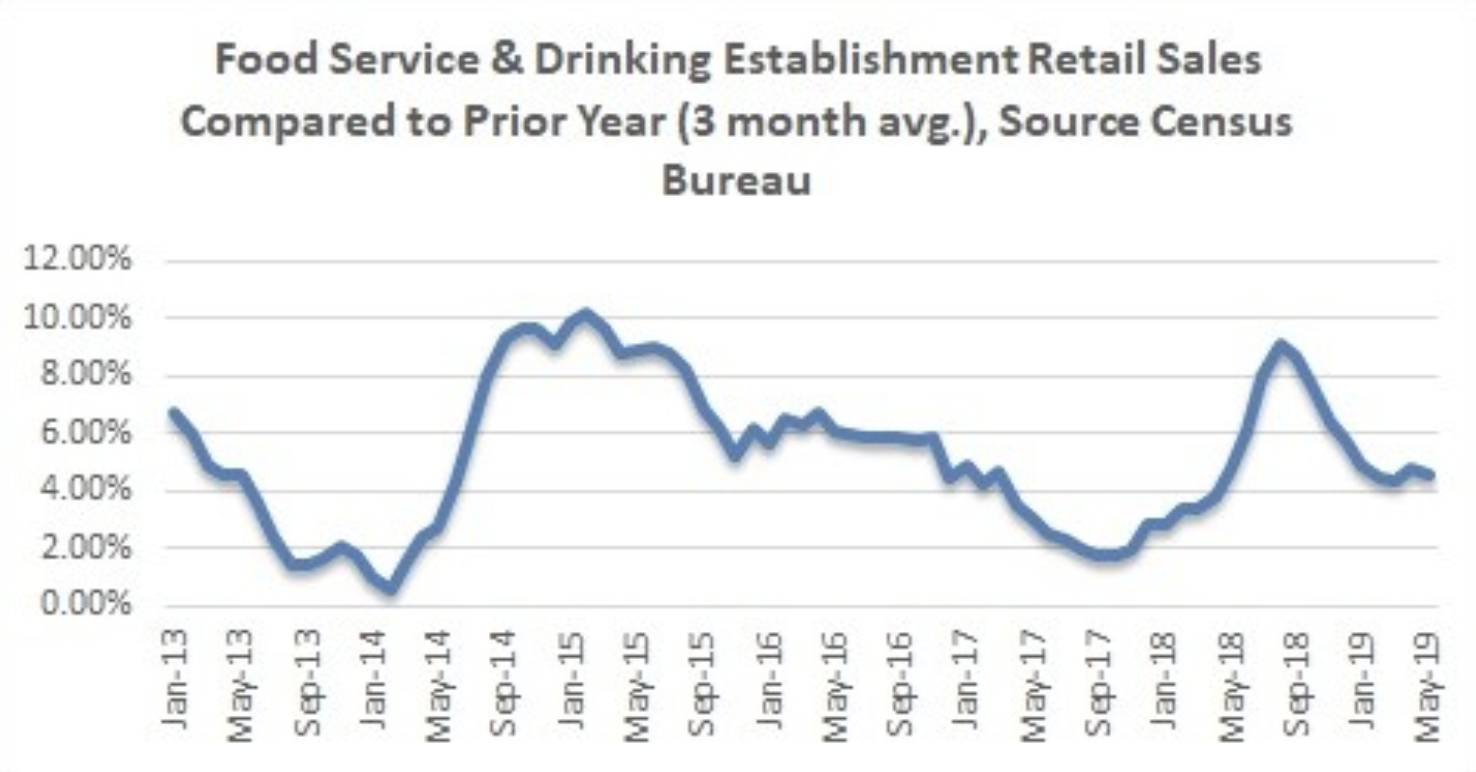

In a recent post, David Maloni, ArrowStream's commodity expert, noted that June retail sales for foodservice and drinking establishments (restaurants) were 4 percent higher than the previous year. Even though that is considerable, it remains the smallest annual gain in the last 15 months. Further, the year-over-year gain in June restaurant traffic at just .9 percent was the smallest since January 2018.

"Perhaps this is due to higher menu prices," said Maloni. "During the month, menu prices were 3.1 percent higher vs. 2018, matching the biggest gain in nearly 11 years. Now part of this is due to higher labor costs and the rise in delivery for the industry. But the lackluster traffic growth raises concerns about the industry’s ability to continue to raise menu prices with this intensity."

Topics: Market Intelligence, Strategic Sourcing

The USDA released its latest crop ratings for corn and soybeans, and David Maloni, ArrowStream's commodities expert, stated the news was underwhelming.

"Just 57 percent of the crop was rated in either good or excellent condition, while only 53 percent of soybeans fell into those categories," said Maloni. "These are the worst crop ratings for the first week of July in seven years and the fifth worst going back to 1990. Not what these crops need, when it is extremely likely that not all of the USDA acreage numbers were planted. The markets will look for improvement in these crop ratings in the coming weeks. But we remain concerned about the 2019-2020 domestic feed supply."

Topics: Market Intelligence

David Maloni, ArrowStream's EVP of Analytics and commodities expert, reported that May's chicken production was 2.2 percent better than 2018 with a year-to-date output higher by 1.2 percent.

"Despite this year’s lackluster chicken production growth and inflated prices, chicken wing consumption has remained resilient," said Maloni. "In May, U.S. chicken wing disappearance was 5.3 percent bigger than the prior year and the second largest for any month on record. And as the chart shows, the 12-month average of wing disappearance stands north of 2.5 percent for the first time in 15 months. We still expect better year-over-year gains in output to weigh on wing prices in the coming months. But the downside will be tempered if consumption remains strong, particularly if retailers step up take-out wing feature activity like they did in May and early June."

Topics: Market Intelligence

As we come off high restaurant sales in May, ArrowStream commodities expert, David Maloni, warns that may be changing.

"May restaurant sales weren’t too shabby," said Maloni. "[They were] .7 percent higher versus the previous month, and higher by 3.7 percent from 2018. Further, the restaurant industry carried 11.92 percent of total retail sales, which is the highest percentage since December. In other words, restaurants got the biggest share of consumer retail spend this year in May. Nonetheless, there are some warning signals with traffic (which includes delivery). May restaurant traffic was up just .8 percent from 2018. Further, the three-month gain in traffic is higher by just 1.6 percent, the smallest gain in 11 months.

Topics: Market Intelligence

David Maloni, ArrowStream's commodities expert, noted the domestic 90 percent beef trim daily settlement market reached its highest level in 20 months.

Topics: Market Intelligence